We Invest our own Money

Where We Suggest You Should

We will never advise you to do anything we are not doing ourselves.

We vet the proucts we offer

Before we offer you a Bitcoin related solution, we have already extensively used that product under many conditions to make sure it is solid

Our Vision and Mission

To empower users in the Latin America with comprehensive, accessible, and unbiased knowledge about Bitcoin and its underlying technology, fostering financial literacy and providing a secure and simplified pathway to participate responsibly in the global digital economy through BTC investment.

Our company is dedicated to become the leading and trusted platform for Bitcoin education and investment in the Latin America, contributing to a more financially inclusive and technologically advanced society where every user can understand, access, and leverage the potential of decentralized digital assets.

Our Reasons

Market Opportunity: There is an “avid crypto community” in Latin America, indicating a strong existing interest. We can serve this community and attract new entrants by providing reliable information and practical guidance.

Education Focus: Given the relatively low levels of practical financial literacy, a strong emphasis on education and breaking down complex concepts into understandable terms is crucial.

BTC Investment vs. Local Issues

The “lack of investment possibilities” for users in Latin American markets, while not an absolute absence, refers to a few key factors that can make traditional investment avenues less appealing or accessible for the average person, thereby increasing Bitcoin’s attractiveness:

1. Limited Access to Diverse Traditional Investment Instruments:

- Underdeveloped Stock Market: While Latin America have stock markets, they’re relatively small and illiquid compared to more developed nations. There are fewer publicly traded companies, and the range of instruments (e.g., ETFs, complex derivatives) is limited. This means fewer opportunities for diversification and growth through traditional equity investments for local individuals.

- Dominance of Fixed Income: The local investment culture has traditionally favored fixed-income instruments, which offer predictable but often lower returns. While this offers stability, it can limit growth potential, especially in periods of inflation.

- High Barrier to Entry for Some Investments: Investing in real estate, while a popular option, can require significant capital, making it inaccessible for many. Direct foreign investment is robust in sectors like tourism and real estate, but these are often large-scale projects, not small-scale individual investments.

2. Inflationary Pressures and Currency Devaluation:

- Erosion of Purchasing Power: Like many developing economies, Latin America has experienced periods of inflation. While current inflation rates might be within the central bank’s target, historical trends and global economic volatility can lead to concerns about the long-term purchasing power of the Latin America currencies.

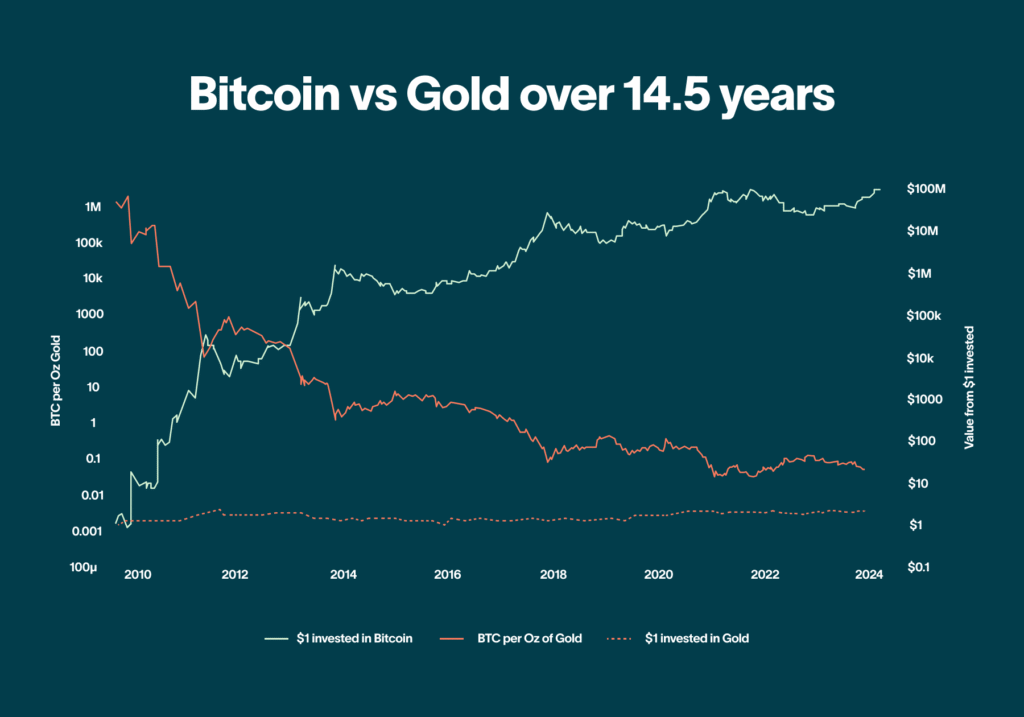

- Search for Inflation Hedges: In environments where local currency is subject to inflation or devaluation, individuals seek assets that can act as a hedge. Bitcoin, with its decentralized nature and fixed supply, is often seen as “digital gold” and a potential store of value, offering an alternative to holding depreciating fiat currency.

3. Challenges in the Traditional Financial System (for some segments):

- Financial Inclusion Gaps: While strides are being made, not everyone in the Latin America has full access to traditional banking services or the knowledge to navigate complex investment products. Bitcoin, with its internet-based accessibility (requiring only a smartphone and internet), can offer an alternative for financial participation.

- Bureaucracy and Trust Issues: Reports indicate that foreign investors face challenges related to corruption, a lack of clear rules, and slow judicial processes in some traditional sectors. While Bitcoin itself isn’t immune to scams or regulatory uncertainty, its decentralized nature bypasses many of the traditional gatekeepers and associated bureaucratic hurdles.

4. High Cost of Remittances:

- Latin America is a significant recipient of remittances. Traditional remittance services often come with high fees and slow processing times. Bitcoin and other cryptocurrencies offer a faster and potentially cheaper alternative for sending and receiving money across borders, which can also be seen as a form of “investment” in preserving value during transfer.

How Bitcoin Becomes Attractive in this Context:

- Accessibility: Bitcoin can be acquired and held with just a smartphone and internet connection, lowering the barrier to entry for individuals who might not have access to traditional banking or brokerage services.

- Inflation Hedge (Perceived or Actual): For those worried about the long-term stability of the local currency, Bitcoin’s limited supply offers a potential hedge against inflation, similar to gold.

- Global Access and Diversification: Bitcoin is a global asset, allowing users to participate in a broader, global financial market that is otherwise difficult to access through traditional local channels. It offers a form of diversification outside of local economic conditions.

- Faster and Cheaper Transactions: For remittances or cross-border commerce, Bitcoin can offer a more efficient and cost-effective alternative to traditional banking rails.

- Empowerment and Control: For some, Bitcoin represents a form of financial empowerment, allowing individuals to have more direct control over their assets without relying on intermediaries, which can be appealing in environments where trust in traditional institutions might be lower.

Your business growth is what we are interested in.

Since we invest our money before our clients do, we have to be sure it’s secure. This is the only way we can ensure mutually assured growth.